How to Create an Investment App?

Nauman Pathan

February 03, 2023 455 Views

Quick Summary : An investing app is a software application designed to help individuals manage and grow their investments through their smartphones or other mobile devices. With the increasing popularity of mobile technology and the convenience it offers, more and more people are turning to investing apps for managing their portfolios, buying and selling stocks, and keeping track of market trends.

Investing might have been a headache before investing in apps. To assess their investment strategy, investors had to locate a financial advisor, speak with them on the phone for hours at a time, and wait for quarterly reports. However, the financial industry has modernized in recent years. Modern technology has streamlined the procedure and opened the investment market to everyone.

It’s time to take a bite out of the market if you want to build an investment app because previous firms have motivated you. The industry is crowded, but if your product is clever, secure, and fills a need, you might make money in the consistently lucrative investing app area. Financial institutions, mostly brokerages and asset management companies, are equipped with the greatest investor and trading platforms in apps for trading stocks and shares. These make it possible for investors from all backgrounds to participate actively. Today, investors should approach the stock market when they are ready to invest rather than the other way around. Apps for investors can make this feasible in the greatest way possible, achieving many investors through smartphones.

Trying to reclaim control of your finances and looking for the best investment apps? A good finance app can manage everyday financial duties, transfer funds to investment accounts, and keep tabs on expenditures. But you can also rapidly trade stocks, monitor your account in real-time, research the markets, and do a lot more using the best simple investment apps.

How Do Investment Apps Work?

Investor apps are growing in popularity almost as much as investing itself. Most financial institutions and brokerages need useful apps to keep up with, much less surpass, the competition. All sectors and industries are seeing a rapid change in the digital ecosystem, and both big and small investment organizations are embracing applications to gain a presence in the market.

You must first open a demat account to invest in the stock market today. You might find it hard to believe, but using an investor app to make stock market investments is straightforward. Although there may be different apps for a laptop and a smartphone, all apps can carry out a wide range of tasks. Creating a complete financial portfolio and keeping track of an investor’s investments are perhaps the most crucial.

Most financial institutions are urging their technology departments to develop internal apps that are increasingly suitable for use by retail investors. An important profession in and of itself, app development is even more in demand in the financial sector if it makes life easier for a busy investor. With the various tasks they carry out nowadays, including providing you with a live view of the stock market, apps are crucial in aiding investors in making investment decisions.

Types of Investment Use

Apps for investing offer data about publicly traded firms, including stock quotations, fact sheets, corporate brochures, and more. Professional investors use these apps to check trends and data while travelling conveniently. Additionally, managing and keeping an eye on many customer portfolios simultaneously using “advanced” membership options is feasible.

They are not, however, the only user base. Thanks to several causes, including improved accessibility, the ability to invest smaller sums, the emergence of cryptocurrencies, and peer-to-peer (P2P) lending, many people now invest surplus funds. In actuality, 55% of Americans own equities, according to Statista. An investing app is useful for all of these people as well.

The table below shows how they can be roughly divided into a few categories.

| Type | Description |

| Exchange-tradedBanking apps | People utilize this particular app to access their bank accounts. |

| Exchange traded funds apps | This type of app delivers investing guides, real-time market data, analyst guides & news to assist the users to decide between purchasing or selling. |

| Investment management app | these apps focus solely on the investments. |

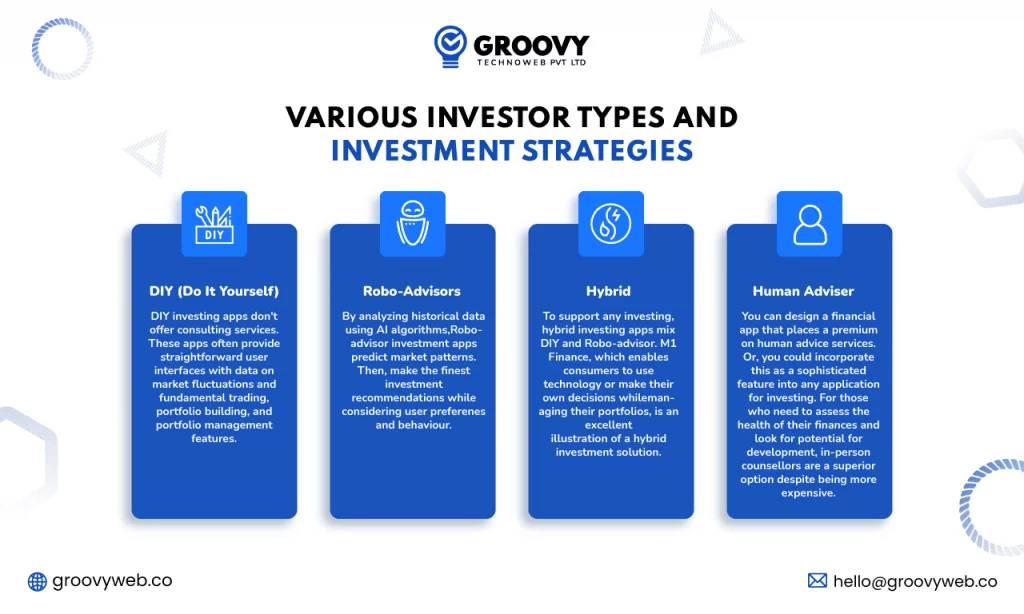

Numerous financial apps today cater to various investor types and investment strategies.

- DIY (Do It Yourself)– DIY investing apps don’t offer consulting services. These apps often provide straightforward user interfaces with data on market fluctuations and fundamental trading, portfolio-building, and portfolio management features.

- Robo-advisors – By analyzing historical data using AI algorithms, Robo-advisor investment apps predict market patterns. Then, make the finest investment recommendations while considering user preferences and behaviour.

- Hybrid– To support any investing, investing hybrid app development or mix DIY and Robo-advisor. M1 Finance, which enables consumers to use technology or make their own decisions while managing their portfolios, is an excellent illustration of a hybrid investment solution.

- Human adviser – You can design a financial app that places a premium on human advice services. Or, you could incorporate this as a sophisticated feature into any application for investing. For those who need to assess the health of their finances and look for potential for development, in-person counsellors are a superior option despite being more expensive.

Even if the task initially looks daunting, you can spend less time making an investment app. To construct the necessary platform and assist you at every stage of your project, from planning to the minimum viable product (MVP) and from the MVP to the finished article, you need an original idea, a well-thought-out plan, and a team of pros.

Stages to creating an investment app:

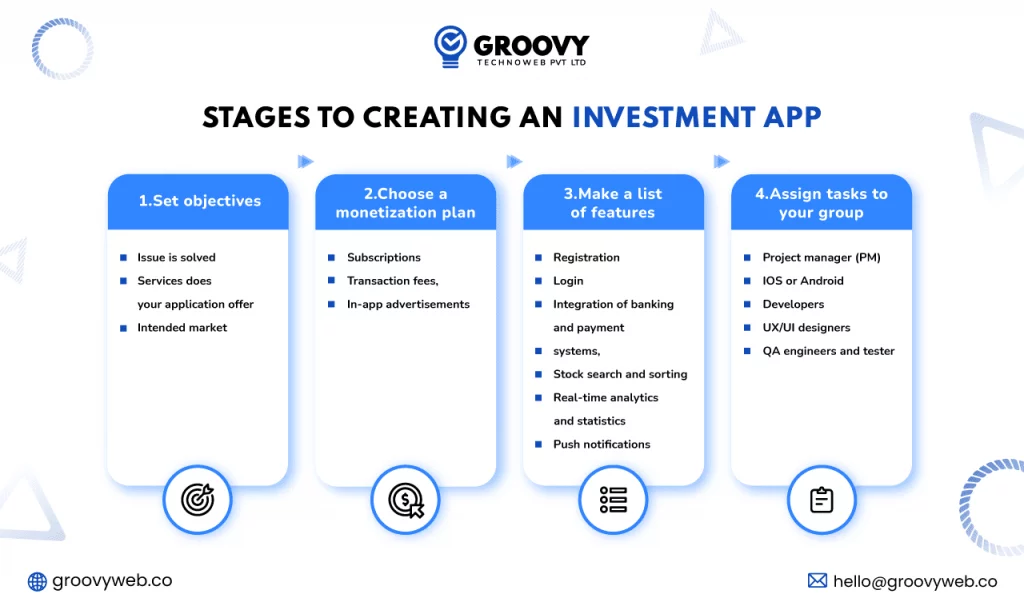

Setting goals, organizing your app’s structure, deciding on a revenue plan, and assembling a development team are the four steps in our cheat sheet that will help you turn your idea into reality. Use it as your main strategy to move quickly toward the finished product stage. Set some objectives first:

#Step 1: Set objectives

Setting goals is the first and most crucial stage in developing an investment app. You can better plan your product, budget, deadline, and marketing strategy if you do this. Consequently, you will have a distinct understanding of your project, target market, and the qualities of your investment product.

Here is a cheat sheet with some important inquiries to address before you start developing your investment app:

- Which services does your application offer? Choose the investing app and the quality of the advising services.

- Who is your intended market? Perform market research, develop audience personas, and assess your rivals.

What issue is solved by your investment app? Learn more about the problems that your target market is experiencing.

#Step 2: Choose a monetization plan

There is only one monetization method that works for some investment applications, but there are several tried-and-true methods that are effective in financial apps. Review them all and remember that you don’t have to stick to just one; you may combine different monetization techniques to find the right balance for your investment platform.

- Subscriptions –Charge customers to access your software, begin trading, or gain access to more sophisticated tools like Robo-advisors. Examples include Charles Schwab Intelligent Portfolios, Acorns, and Fidelity Go.

- Transaction fees –Fees are assessed for making deposits, withdrawals, asset purchases, and sales.

- In-app advertisements – Include advertisements in your app to keep it free. But keep in mind that customers frequently find in-app advertisements unpleasant, so only promote relevant things.

#Step 3: Make a List of Features

Depending on the investing app, a different functionality will be integrated. For robot-advisory apps, you need AI technologies that find and analyze investment opportunities, whereas live chat is necessary if you offer consultations with human advisors. Having stated, and different stages of development mobile app all forms of online investment apps include:

- Registration– It’s a good idea to provide users with a few options for registering; for instance, you can use ID sign-ups in addition to the more common email and password options.

- Login– For bank-level security, like with all the finance app projects has done, we advise two-factor user authentication.

- Profile– An individual’s profile with a “Settings” area for adding and managing personal data, accessing bank information, setting preferences, etc.

- Integration of banking and payment systems– Give users the option to link their bank accounts and conduct safe deposits and withdrawals.

- Stock search and sorting – The purpose of your software is to let users look at stocks and investment opportunities. Create categories for simple navigation and include sophisticated capabilities for filtering and sorting.

- Real-time analytics and statistics– Provide charts and graphs with as much information as possible, including market trends, past asset performance data, user earnings data, and the like.

- Push notifications– Notifications are an excellent method to interact with users and keep them updated on industry trends, investment opportunities, and expert advice.

#Step 4: Assign tasks to your group

It’s time to put a group of experts to work. It would help if you had an entire team of experts to build an investment app:

- Project manager (PM) – To oversee your app development team, create a solid plan and roadmap for the project, and assist you in establishing your needs and budget.

- iOS or Android developers– To make your project a reality, you require front-end and backend, software developers.

- UX/UI designers— These professionals optimize the usability and aesthetics of your app.

- QA engineers and testers – must extensively test the website to ensure consumers have a smooth experience.

You have three possibilities on how to create such a team. Initially, you may look for app developers and other team members on freelance sites, but you must be assured that you’ll discover skilled experts or meet your deadlines.

The second option is to put together an internal team. Although this sounds like a better option, it could be more economical. Hiring experts will cost you time and money, but you’ll also need to supply the technology and software.

The third and best choice is to work with an established development firm—no need to spend money on pricey technology and software or time hunting for experts. Additionally, you gain from the knowledge and suggestions of seasoned specialists at each stage of the project.

The Importance of Investor Apps:

Apps for investors take the place of hiring professional brokers to handle investing needs and operations. This indicates that the platform has any information that could aid investors in investing. The app platform, for instance, will provide important details about a stock exchange or any other supporting services.

The time-saving features that investor applications provide are the major way they assist investors in making wise decisions. Additionally, investor applications have blogs and instructional videos that offer advice on the best tactics and hot stock picks. With any investor app that enables you to trade on the stock market today, you can view real-time photographs of the stock market. You can find ways to invest that satisfy specific needs by using investor apps that include additional investment tools.

Advantage of Investment App

- It removes the intermediaries, allowing you to purchase and sell without speaking to your broker. Online trading can therefore be appealing to investors who lack the means to hire full-service brokers.

- Why It’s quicker and less expensive: You pay more when a broker executes your trades. On the other side, when you trade online, a brokerage fee is charged, but it is always less than what a normal broker would charge if the trade had to be made in person. Trading online happens almost instantly.

- It provides better investor control: Giving you more control over your money is one of the most significant benefits of online trading.

- You can keep tabs on your investments in real time: Your online trading platform is equipped with various cutting-edge tools and user interfaces that let you keep track of your performance and do independent research. Every time you check in using your phone or computer, you can view gains and losses in real time.

What Are the Basic Goals of Investment App?

- Safety

It is believed that no investment is 100 per cent safe and secure. However, you can come fairly close.

In stable economic regimes, one is to invest in government-issued securities.

AAA-rated corporate bonds issued by big, dependable corporations come second in terms of safety. These securities may be the best way to protect your principal and earn a fixed interest rate.

The risks resemble those associated with government bonds. To be concerned about losing money if you invested in IBM or Costco’s bonds, you’d have to picture them going out of business.

The money market is another place to find secure investments. These securities include Treasury bills (T-bills), certificates of deposit (CDs), commercial paper, and bankers’ acceptance slips, descending in risk level from highest to lowest.

Safety carries a cost. Compared to the possible returns of riskier investments, the rewards are really low. Opportunity risk is what we refer to as this. Those who choose the safest options could forfeit significant prizes.

Additionally, there is some degree of interest rate risk. In other words, you may invest your money in a bond that offers a 1% return while keeping an eye on the 2% inflation rate. You just suffered a loss in terms of actual purchasing power.

Short-term assets like 3-month and 6-month Treasury bills are the safest investments.

- Income

Some of the fixed-income assets that were previously discussed can be purchased by investors that prioritize income. However, they start to prioritize their income. They are looking for investments that would ensure a supplemental, stable income. They could take on a little bit more risk to get there.

The goal of retirees who wish to create a consistent monthly income while keeping up with inflation is frequently to do this.

- Capital Gains

By definition, capital growth can only be attained through the sale of an asset. Stocks are a form of capital. With dividend payments, their owners can sell them to make money.

Other forms of capital growth assets include everything from diamonds to real estate. They all have a certain level of risk for the investor. A capital loss is a result of selling something for less than what was paid.

- Dashboards for analytics

Your clients may get the insights they need to make decisions by using a dashboard that will automatically provide information in a user-friendly way.

- Integration of KYC and AML

The Know Your Customer (KYC) and Anti Money Laundering (AML) fintech security regulations should be met by investing app without losing the user experience.

- Real-time warnings

Give consumers access to personalized push notifications, reminders, and instant alerts. By doing so, you can inform your customers about the state of the stock market, investment returns, unusual behaviour, special deals, and discounts.

- Automated therapists

Consider including automated online investment advice (Robo-advisors) in your fintech software development services.

- Financial calculators

Assist customers in determining how to achieve their objectives by looking at a primary investment, the timing of deposits, the frequency of contributions, and risk tolerance.

- 24-hour support

You should consider ways for users to contact you if they have inquiries. So, consider adding a chatbot, a callback feature, or a 24/7 support staff.

The usage of this app is growing:

It is indisputable that apps are becoming increasingly popular in today’s society. Apps facilitate your work and speed up decision-making, whether opening a demat account or investing in mutual funds. By purchasing growing stocks, you can take advantage of opportunities as they arise. With investor applications, you can take advantage of any investment opportunity, such as investing in an impending IPO on schedule and meeting a deadline. A smartphone is all you need to invest if you’re a potential investor. Various apps are available for download, depending on the kind of investments you want to make. As a result, apps assist you in diversifying your holdings and selecting products wisely in the future. Today’s youth may utilize apps in every region of India, encouraging financial planning at a young age, but older people also find the apps useful.

Checklist for developing investment apps

Let’s finish by offering some advice to make sure the development of financial apps goes well.

- Look for full-stack programmers with subject experience if you want to create a successful online investment software.

- Don’t skimp on the cost of testing. In Excel or on paper, a formula might function flawlessly, but in code, it might not.

- The easier it is for the developers to comprehend what needs to be done, the more specific your requirements should be.

- To solve technological problems when creating an online investment app, third-party APIs are useful.

- Keep in mind that you are the financial expert, not the programmers. It would be wonderful if you occasionally held workshops to go over the business logic and the function set. Choose the team’s most efficient communication method as best you can.

What is the price of developing a mobile application for an investment firm?

What precisely do you pay for when creating a mobile application? The price of developing an investment app relies on the following:

- Business evaluation

At Relevant, we begin the creation of investment apps by examining business requirements, outlining the objectives, and gathering client specifications.

- Process of design

After the planning stage, we create wireframes, mockups, and a clickable prototype based on the results.

- Development

We begin writing code after design solutions have been approved. Our team works in two-week sprints and offers deliverables to the client in chunks since we use the Agile methodology.

- Evaluation and launch

Depending on the project’s needs, we either test the code as it is being created or periodically during the software development life cycle. We polish the software, try its functionality on various devices, set up the servers, and get it ready for release. Then, we test it once more in a real-world setting.

- After-launch assistance

After the public release, we continue to monitor the operation of your online investment app, optimize the speed (if necessary), address any remaining defects, and offer suggestions for enhancements.

- Platform control

The app’s setup and management are entirely your software provider’s technical responsibility. Therefore, you won’t need to worry about the lag-free operation. To satisfy your company’s needs, you will need to apply the proper settings and add pertinent material yourself. You must also oversee the onboarding and training of new hires.

The first step for wise savers is to accumulate enough emergency funds in a savings account or by investing in a money market account. However, investing in the financial markets offers a number of possible benefits after accumulating three to six months’ worth of easily accessible funds.

Why is investing important?

An effective way to manage your finances and maybe grow your wealth is through investing. The key factors causing investments to have a higher growth potential are the power of compounding and the trade-off between risk and return.

- leveraging compounding

When dividends or earnings from an investment are reinvested, compounding takes place. These gains or dividends then lead to further gains. In other words, compounding occurs when your investments produce income from income that has already been generated.

For instance, if you invest in a stock that pays dividends1, you could think about reinvesting the dividends to maximise the potential power of compounding.

A rising number of people are choosing to manage their money primarily through tablets or smartphones, which has corresponded with the rise of investment apps and the change in consumer preferences. By concentrating on enhancing their mobile app experiences, stock trading and robot-advisor companies have embraced this transformation.

The user interfaces and functionality of mobile and desktop trading platforms for brokers are becoming increasingly similar, despite the fact that desktop platforms have historically had greater features and capabilities. Investors benefit from a more synchronised experience in terms of alerts, watchlists, and updates, thanks to the enhanced consistency between mobile and desktop. It also makes managing your money and keeping an eye on your investment goals easier.

Conclusion

As more and more users sign up for these platforms to increase the growth of their financial assets, investment apps are growing in popularity. Thanks to low fees, straightforward trading and investing procedures, and effective AI-powered advisors, user retention is excellent. Despite the market’s fierce competition, newcomers, especially those with creative ideas, are always welcome. Develop a clever, safe solution with Groovy Web that meets user needs, and you should quickly estimate your mobile app development costs.

Written by: Nauman Pathan

Nauman Pathan is a Project Manager at Groovy Web - a top mobile & web app development company. He is actively growing, learning new things, and adapting to new roles and responsibilities at every step. Aside from being a web app developer, he is highly admired for his project management skills by his clients.

Frequently Asked Questions

We hope these clear your doubts, but if you still have any questions, then feel free to write us on hello@groovyweb.coWhat is the best strategy for beginning to invest?

If your goal is retirement, which is more than 20 years away, almost all of your assets can be placed in equities. However, picking certain businesses can be challenging and time-consuming. Because of this, the best way for most individuals to invest in stocks is through affordable stock mutual funds, index funds, or ETFs.

When should one begin investing?

If you put off investing in your 20s because of student debt repayment or the ups and downs of starting a profession, you should start saving in your 30s. Although you are old enough to invest 10% to 15% of your salary, you are still young enough to benefit from compound interest.

Related Blog

Ashok Sachdev

What is PHP for Web Development and Why Should You Use It?

Web App Development 06 Feb 2023 11 min read

Krunal Panchal

How Much Does it Cost to Develop An On Demand Food Delivery App

Mobile App Development 21 Aug 2023 10 min read

Ashok Sachdev

31 Best Chrome Extensions For SEO Marketers In 2023

Web App Development 06 Jun 2023 11 min readSign up for the free Newsletter

For exclusive strategies not found on the blog